The Texas Highway Patrol Museum was a weird place. It used to sit on a busy street corner near downtown San Antonio. Yet whenever I drove by, I hardly ever saw anyone inside. More than once I wondered, what’s the deal?

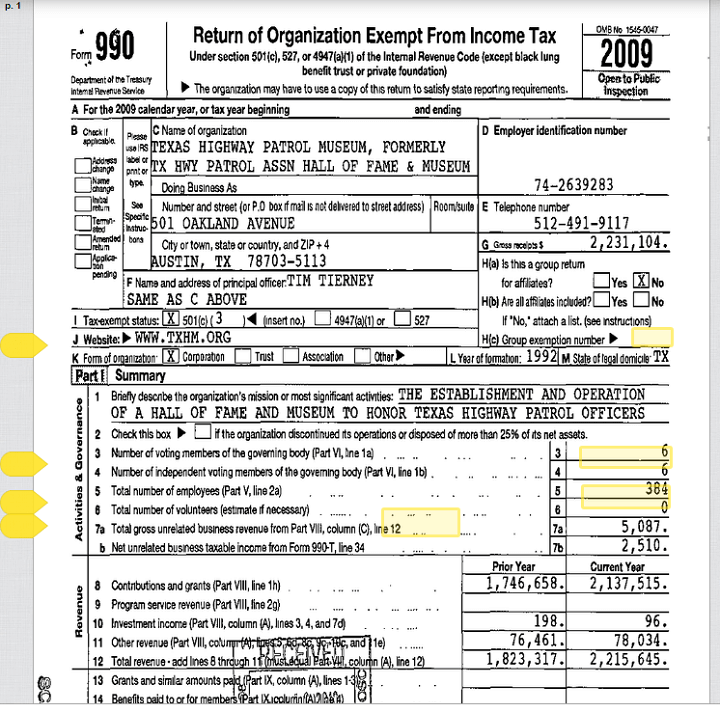

I found the answers in the IRS Form 990 — the publicly available tax filing that must be filled out by a variety of nonprofit organizations in the United States.

I found the answers in the IRS Form 990 — the publicly available tax filing that must be filled out by a variety of nonprofit organizations in the United States.

It turned out the museum was overseen by a tax-exempt charity, which meant its tax records were open to the public, which meant anyone curious about the museum, like me, could learn all kinds of things about its finances.

The tax records helped me write a series of news stories about how the museum was actually a telemarketing operation that raised $12 million from 2004 to 2009 in the name of helping the families of state troopers who died in the line of duty. For every dollar raised, this “charity” had actually spent less than one penny on that worthy goal.

The museum’s activities had already caught the attention of the Texas Attorney General’s office and it went to court to shut down the telemarketing operation, claiming it was duping donors.

Today, the museum is history. The story I stumbled across offers a lesson for any journalist who writes about a nonprofit organization at some point in their career (and we all do). It pays to take the time to look up the 990 — even for seemingly innocuous stories.

The 990 filing, while not perfect by any means, is a road map that can guide you to a better understanding of how a charity works. How much money does it make? How much does it pay its executives? Has it ever been the victim of embezzlement?

The 990 isn’t just a tool for journalists, either. It’s for anyone who wants to know more about a charity. These organizations are often holding out their hats for donations. In return, you’re allowed to look at how they handle the money they raise. And it’s easier than ever to get your hands on these tax records online, often for free.

Here’s how to find 990s and analyze them. Sometimes, the things you discover will raise questions that need to be answered by the charity. But you’ll never know to ask those questions unless you read the 990.

Obtaining tax records of charities

Different types of nonprofits fall under the U.S. Internal Revenue Code. Many follow 501(c)(3) of the code, which covers charities that raise funds from a variety of donors. There are also charitable foundations that rely on fewer benefactors. Churches don’t have to file a 990. But religious schools and private universities do.

The IRS says you can visit the office of any group that falls under 501(c)(3) and request copies of their tax filings for the past three most recent years. If they made more than $25,000, they’re supposed to file a 990-EZ or the full 990 form, depending on their revenue. But if you’re in a hurry or don’t want to raise alarm bells at the nonprofit, there are also free online tools to obtain the records.

The pioneer in making 990s widely available is Guidestar.org. Sign up for a free account, and Guidestar lets you search by keyword and location to find the charity of your choice. Click on a profile, and you can download recent 990 tax forms.

OK, so you found the 990 you’re looking for. Now what?

Analyzing the 990

Here are a few things I usually look at. The front page of the 990 gives you an overview of the organization:

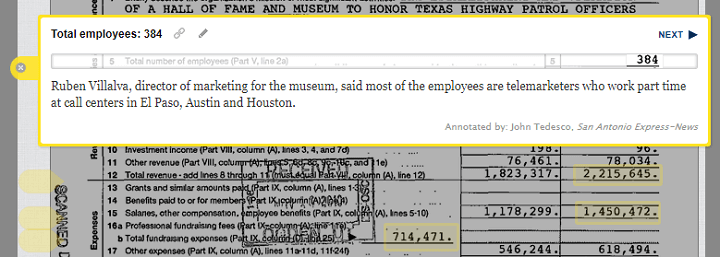

You can find basic information, such as the main office address and phone number, the year the charity was founded and how many employees it has:

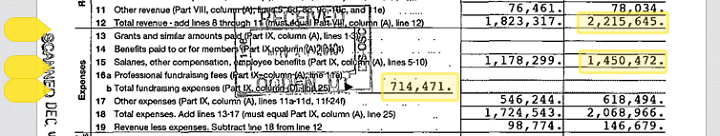

You’ll also find the overall revenue, expenses, fundraising numbers and whether the group made or lost money. Remember, nonprofit doesn’t mean no profit:

In the case of the obscure museum I was curious about, we can see that its telemarketers raised $2.2 million in 2009. Is that a lot or a little? Whenever you look at a financial document, it’s helpful to compare it to past reports to put those numbers into context. My suggestion is to look at several years of 990 filings. Plug the numbers you’re interested in into a spreadsheet, and you can now spot trends.

In my case, I was interested in how much money the museum raised, and how much money its related nonprofit entity was donating to the families of fallen state troopers. The San Antonio Express-News has a paid account with Guidestar, which let us download 990 tax filings for the previous five years. I typed the revenue totals and payments into a spreadsheet:

Across a broad time frame, it was clear that little money was trickling down to the families who needed it.

Digging deeper

The second page of the 990 has the mission statement of the organization and what it claims it accomplished — useful if you want to compare the rhetoric to reality.

Page 3 is the beginning of a lengthy questionnaire. Interesting nuggets might be buried there.

Part VI of the questionnaire asks about the management of the organization and whether it had a “significant diversion” of assets that year. If an organization checks “yes,” that usually means it was the victim of theft.

You don’t see this checked “yes” very often, but the Washington Post published an excellent series in 2013 about more than 1,000 organizations that lost millions of dollars.

Answering “yes” to questions in the questionnaire can trigger a requirement to fill out supplemental information further down in the 990. There you can find, for example, “Schedule O,” which is where the charity explains how the “significant diversion of assets” happened.

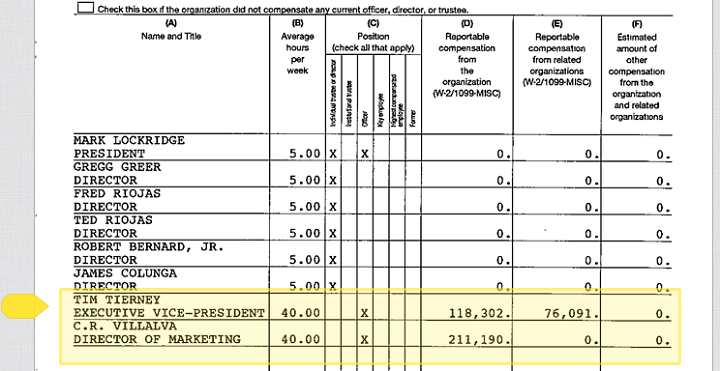

The salaries of the nonprofit’s top employees and the identities of board members often makes for interesting reading, which you’ll find in Part VII of the 990:

Some organizations fill this out in an attachment because it’s so long.

Again, be on the lookout for supplemental information toward the back of the 990 for more information about how employees and board directors are compensated.

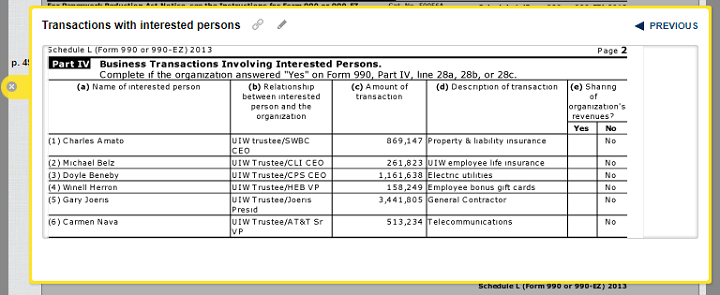

You might find a “Schedule J” that fleshes out compensation packages for the group’s leadership. You might also find a “Schedule L,” which details “transactions with interested persons.” That probably sounds better than what it is, the “Potential Conflict of Interest” section. This is where a charity might report “excess benefit transactions” to the IRS, which means it overpaid in a transaction with someone who had ties to the organization, such as a charity executive.

Part IV of Schedule L lists business transactions with “interested persons,” such as board members. Last year, this section caught my eye when I was covering a rare, public clash between Louis Agnese Jr., the longtime president of the University of the Incarnate Word, and UIW’s board. In Schedule L, Incarnate Word reported several transactions with businesses tied to the school’s board members, including Charles Amato, the past chairman of the board:

Such transactions aren’t illegal. But Agnese’s critics said the board at UIW had always strongly supported Agnese. It was surprising when the new chairman, Charles Lutz, announced he couldn’t condone Agnese’s conduct.

You also might find “Schedule R,” which details related organizations and partnerships, and any transactions with them. This is where I learned the Texas Highway Patrol Museum was tied to other organizations, which led me to yet more 990 tax filings.

Tying it together

Remember the cover page of the 990 and its overview of revenue and expenses? Be sure to review three sections that offer greater detail on those subjects.

Part VIII is the “Statement of Revenue,” which breaks down revenue streams for an organization. You’ll find how much money comes from membership dues, fundraising events, government grants and other categories.

Part IX is the “Statement of Functional Expenses,” where you can find how much an organization spends on advertising, legal fees, travel and other expenses.

Part X is the balance sheet, where you can see the breakdown of assets and liabilities. You can check for things like how much cash the group had on hand at the beginning of the year compared to the end of the year.

This numbers might not seem very sexy. But the simple act of reading them, plugging them into a spreadsheet and comparing them over time can lead to good questions and beef up a mundane news story.

What’s in a name?

Keep in mind that some organizations call themselves “foundations,” but they might not be. A foundation usually relies on one or several wealthy benefactors, and by law, it must spend at least five percent of its investments on charitable purposes.

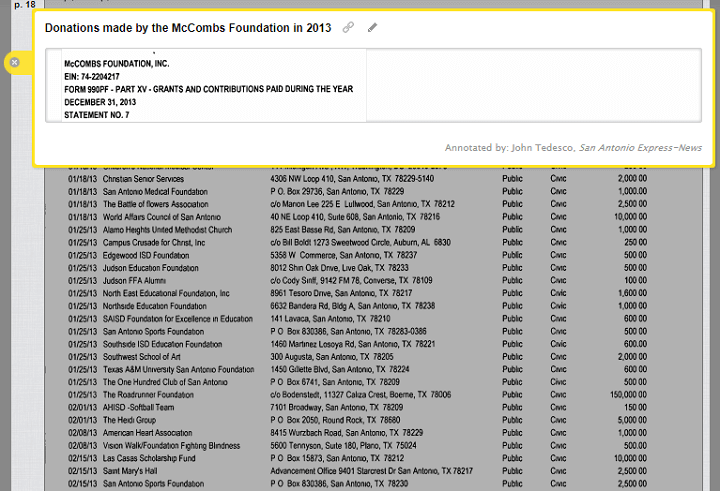

Foundations file a slightly different tax form called a 990-PF. One difference is that the foundation lists its grants and recipients. You can see where the money’s going and where the foundation’s priorities lie.

This came in handy when I profiled San Antonio billionaire B.J. “Red” McCombs, who has made headlines for big-ticket multi-million dollar donations that gets his names on buildings. But the 990-PF for his foundation listed a variety of gifts totaling $4.7 million, most of which were smaller donations that never made the news.

“Those gifts you never hear about,” McCombs told me. But he’s convinced the smaller donations make a difference. “If it’s to the food bank, for example, we fully believe that they can take $100 and do five times as much with it as as we could possibly do.”

Other helpful websites

The 990 is a starting point. Even Guidestar, which revolutionized public access to 990s, cautions that these tax records aren’t the best barometer of whether a charity is fulfilling its stated mission.

But the 990 can still be useful. Time after time, I’ve found gems in these seemingly dry tax filings that made me a little more informed about a charity and gave me good questions to ask.

Here are some other resources for finding 990s and checking out nonprofits any time you drive by, say, an empty museum and wonder what their deal is:

What a great read! I stumbled on your blog from a mutual Facebook friend, and I’ve really enjoyed everything I’ve read so far. Thanks for helping keep journalism alive! You’ve got a subscriber in me.

Thanks Amanda, glad you liked it.